Copper concentrates come in two “flavours” – Clean and Complex.

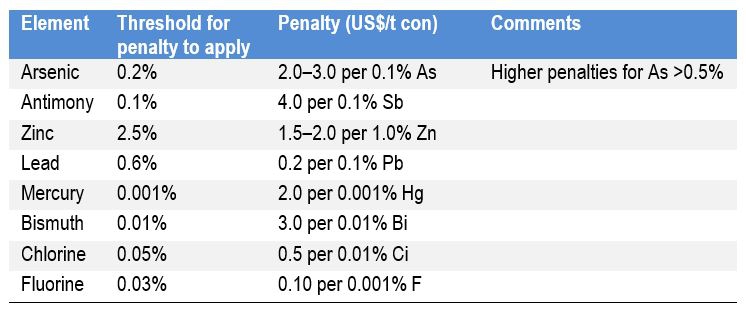

Clean copper concentrates have more than 20% copper and possibly gold and silver and low levels of the deleterious elements As, As, Bi, Cd, Cl, F, Pb, Hg, U and Zn. In addition, asbestos (referred to as fibre) is present in a small number of mine product streams. The Complex Concentrates have high levels of one or more deleterious elements. Each of the deleterious elements will have a threshold level in the offtake contract where the smelter will charge a penalty in addition to the treatment and refining charges. The penalty accommodates the increased costs of disposal and safe disposal.

There is frequently an upper limit for some deleterious elements, above which the smelter may refuse to accept the concentrate.

The most common deleterious element in copper concentrates is arsenic. Globally 65% of copper concentrates have less than 0.1% As. Above 0.2% arsenic, copper concentrates are considered to be Complex Concentrates and will be charged penalties. In the last decade, as new mine copper production has slowed the quantities of Complex Concentrates entering the market increased significantly while smelter capacity for these concentrates has declined.

Complex concentrates from Marcapunta in Peru (8% As), Chelopeche in Bulgaria (6% As) and Chuquicamata in Chile (1.2% As) have been the main producers. They have been joined more recently by production form Toromocho in Peru (1% As) and Ministro Hales in Chile (4% As).

Smelting Treatment Options

Prior to the 1990s there were many smelters that would accept copper concentrates with high deleterious element concentrations. However due to environmental concerns, liability concerns, tightening regulations and smelter closures at La Oroya in Peru, San Luis de Potosi in Mexico, Tacoma in the USA, Rönnskär in Sweden, PASAR in the Philippines and Kosaka in Japan, the number of smelters that will now regularly accept Complex Concentrates has declined very significantly.

Smelters that will now accept Complex Concentrates include Tsumeb in Namibia, Altonorte in Chile, Guixi in China and Horne in Canada. For complex concentrates that contain more than 1% arsenic, the Dundee Precious Metals smelter in Namibia at Tsumeb is now the only smelting option.

Most of the smelters which would previously accept high arsenic concentrates utilised roasters to fume of the Arsenic to produce arsenic trioxide (for which there is a limited market) and calcined copper with much reduce arsenic levels. Only Tsumeb still operates such a process facility.

Codelco installed an Outotec Partial Roaster (a fluid bed roaster) at its Ministro Hales mine in 2013 to reduce the as content of the copper concentrates. It is located close to Codelco’s Radomiro Tomic and Chuquicamata operations. Initially the project comprised an open pit mine, a 50 kt/d mill to produce 163 kt/a Cu and 287 t/a silver over a 14-year mine life. The ore contains a significant amount of arsenic (around 1.6-1.9% As) that results in production of concentrate with arsenic content just above 4%. To reduce the arsenic levels, a 550 kt/a fluid-bed roaster was constructed to safely process copper concentrate and recover arsenic for further confinement. In addition to calcine and sulphuric acid, the roaster produces flue dust (around 4% volume) containing 22% Cu.

Hydrometallurgical Treatment Options

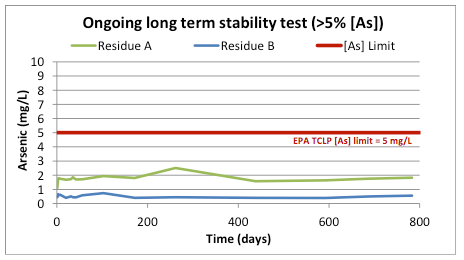

There are a number of hydro-metallurgical treatment options (few of which have achieved commercial success) which do not involve roasting where the objective is to produce a residue containing arsenic in a form which is stable within a tailings dam. These process routes include atmospheric leaching, bio-oxidation and pressure leaching. Dundee Precious Metals prior to its acquisition of the Tsumeb smelter had attempted to permit a pressure oxidation circuit at its Chelopeche mine in Bulgaria but faced opposition for the usual socialist “ecological” groups.

Teck Aurubis have trialled their proprietary high pressure oxidation technology, CESL, on concentrates with up to 10% arsenic and report greater than 99% deportment of arsenic to leach residues. Arsenic components in the residue have been identified as ferric arsenate and scorodite – both of which are considered the most stable forms for arsenic fixation. Teck Aurbis have achieved >97% copper and >90% Au and Ag recovery, LME grade copper cathode and gold and silver Dore production.

Blending Options

Due to the limited capacity and high costs of the smelters capable of accepting high arsenic concentrate, blending of clean and complex concentrates to produce a product that is below the smelter deleterious element thresholds has become a significant business opportunity. Generally, this is below the 0.5% Chinese threshold and the main blended concentrate target is Chinese smelters.

In 2014 Codelco set up a strategic alliance with Ocean Partners to blend high-As copper concentrate from its Ministro Hales mine with clean third-party concentrate bought in by both companies, at Ocean Partners’ concentrate blending facility in Taiwan.

In the near term it appears likely that the percentage of concentrates subject to arsenic penalties will increase, as will the percentage of Complex Concentrates in the market. In response to this Glencore has opened a new copper concentrate blending facility in Taiwan and a number of Chinese smelters are looking at locating blending and scrap processing operations in the region.