Without subsidies and the ongoing presence of backup power based on fossil-fuel generation, the outlook for more renewable energy in Australia is extremely uncertain. Indeed, without the intervention of governments, the salad days for renewable energy will quickly fade.

The Australian 1st September, 2018

Judith Sloan

One of the most astute investors in the world is Warren Buffett. Since 2004 his company, Berkshire Hathaway, has invested more than $US17 billion in renewable energy, predominantly wind farms. In case you think Buffett is some bleeding-heart global warming believer, here is his explanation for the investment: “I will do anything that is basically covered by the law to reduce Berkshire’s tax rate … We get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

Under the US production tax credit scheme, American taxpayers forked out more than $US14bn to renewable energy operators between 2014 and last year. The scheme provides for a tax credit of $US23 per megawatt hour and each project can claim this credit for 10 years. Unfortunately for the renewable energy sector, the scheme is being phased out.

Moreover, with the dramatic cut to the federal company tax rate (from 35 per cent to 21 per cent) implemented by the Trump administration, the value of tax credits for existing renewable energy schemes suddenly has dropped.

Just recently the plan to construct the largest wind farm in the US, to be located in Oklahoma, has been shelved. The business case for the project just didn’t stack up without the tax credits. Its location in a remote, albeit windy, part of the country meant that close to 900km of transmission lines would need to be built. The cost of and local opposition to the erection of the pylons were further factors killing the project.

It’s early days, but there are indications that investment in renewable energy worldwide may have peaked and is trending down.

To be sure, there is the left-wing Californian government proposing that the state’s electricity generation should be carbon-free by 2045, although electricity still will be sourced from interstate generators using fossil fuels.

By contrast, the recent election of a conservative government in Ontario — Canada’s most populous province — and the wipe-out of the previous progressive Liberal government has meant a rapid reversal of fortune for renewable energy there. The Liberals had held power since 2003, implementing a radical green agenda. Coal-fired electricity plants were closed, albeit with significant delays, and incentives were put in place for investment in renewable energy projects, particularly wind farms.

Ontario joined a limited cap-and-trade scheme with California and several US eastern states, thereby imposing a form of carbon tax in Ontario. Interestingly, the emissions reduction targets set by the Liberal government still were not achieved, notwithstanding these interventions. The election of Progressive Conservative Premier Doug Ford has taken a big stick to most of these policies. The latest cap-and-trade auction has been cancelled and approvals for new wind farms have been withdrawn. The $C14,000 ($14,863) subsidy to the purchasers of electric vehicles has been cancelled.

At a federal level in Canada, the Trudeau government has run into difficulties with its plan to impose an escalating carbon tax. The original idea was that the tax would be levied in all provinces deemed to be acting inadequately to reduce emissions. Some provincial governments are threatening to sue the federal government. And the Trudeau government has needed to tweak its carbon tax plans to deal with the commercial threats to energy-intensive, trade-exposed firms operating in Canada. This situation has been made more difficult by the recently imposed tariffs on some Canadian exports by the US administration.

In Germany, the solar industry basically has collapsed in line with sharply reduced subsidies from the government. Subsidies to wind turbines have operated since 2000 but are due to run out in 2020. Some older turbines will need to be decommissioned, raising several thorny issues, including the lack of provisioning for the costs by the operators. The blades are incapable of being recycled and the turbines are anchored to the ground using hundreds of tonnes of concrete, making the decommissioning process problematic. One estimate puts a potential loss of existing turbines in Germany at 5 per cent of the stock by 2022.

German Chancellor Angela Merkel is under pressure to extend the life of coal-fired power stations. And recently she rejected the proposal of several EU countries to lift the shared emissions reduction target by 2030 from 40 per cent to 45 per cent. This is notwithstanding her earlier support for the higher target.

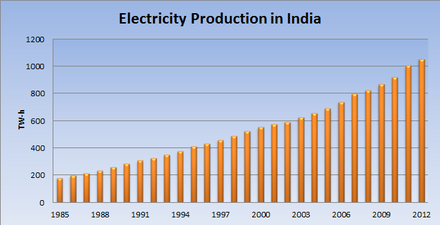

China often is cited as an example of a country that has invested heavily in renewable energy. What is less often cited is China’s substantial investments in new coal-fired and nuclear power stations. Providing affordable and reliable electricity across the country while shutting down old coal-fired power stations with damaging particulate emissions has been the top priority in China for some time.

A major event occurred in June with the decision of the Chinese government to slash the subsidies paid to solar power operators. In the future, there will be no subsidies and the incentives for existing projects are being cut to 10c per kilowatt hour. As a result of this change, the price of solar stocks has fallen significantly. (We should note here the dominance of China in the production of solar panels. Of the 10 largest firms, seven are China-based and another is based in Hong Kong. There is a large supplier in Canada but the firm has Chinese links.)

So what does this mean for Australia? The renewable energy sector is keen to spruik its economic case. It notes that about 7200MW of capacity has been added in the past few years, although this is nameplate capacity rather than actual 24/7 generation capacity. It also notes that the cost of renewable energy is falling, more so for solar than wind.

The combination of the dying days of the renewable energy target and active subsidisation of renewable energy projects by state and territory governments, mainly through the reverse auction process, has driven this latest burst of investment in wind and solar farms. However, no new projects are proceeding in which operators are taking the merchant risk. (A possible exception could be Chinese-backed projects.) Without power purchasing agreements from users, no new projects are likely to proceed.