Natural Resource Governance Institute has issued a report on revenues received from listed mining companies in Ghana. As many who have done the cashflow analysis have long known that a free carried interest, funded out of cashflow is a less than effective tool for garnering rent from resource projects. Projects can often take many years to repay capital and if this period corresponds with low or stagnant commodity prices then dividend payments may be low. In effect the state is fully exposed to commodity price and operational risks. A better solution is a competitive royalty, fee and taxation environment which is adequately regulated.

One of the issues with a carried interest is that this often involves representation on the board of the operating entity and as such creates immediate conflicts of interest for directors and heated domestic competition for these positions. That said, there are often political arguments for a carried interest, arguments about national interest. In addition it has been argued that being represented on the board of the operating entity allows governments to “keep an eye on” the operator. A better solution is robust oversight by a suitably trained and funded Department of Mines.

ghana-gold-mining-revenue-analysis-company-disclosuresIn Ghana the majority of international mining companies, including Asanko Gold, Golden Star Resources, Endeavour Mining, Kinross Gold, Perseus Mining and Xtra-Gold Resources, have disclosed payments-to-governments reports under the Extractive Sector Transparency Measures Act (ESTMA) in Canada. In addition Gold Fields, AngloGold Ashanti and Newmont Mining have made voluntary disclosures regarding the payments they make to the Ghanaian government.

Data were sourced from companies complying with the Canadian, Extractive Sector Transparency Measures Act (ESTMA).

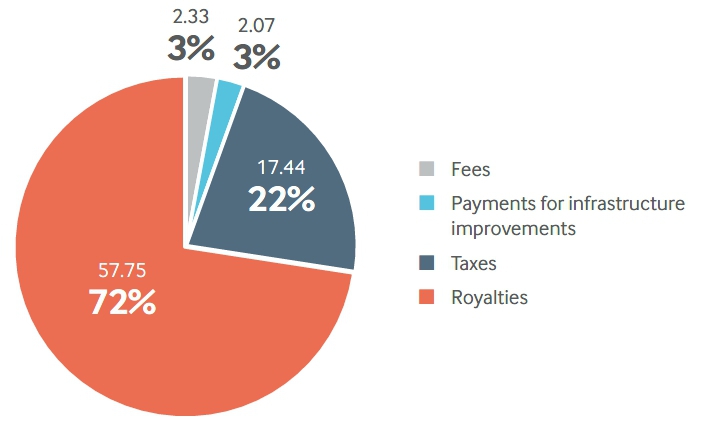

In 2017 nearly three quarters of the payments to Ghanaian government entities by ESTMA companies in the gold sector arose from royalties, with five companies paying a total of USD 57 million. A further 22 percent of the payments from these ESTMA companies were in the form of corporate income tax. While six operating companies paid royalties in 2017, only two, Kinross Gold Corporation and Endeavour Mining paid corporate taxes.

Ghana’s Vice President Mahamudu Bawumia has questioned the utility of the government’s 10 percent equity interest in mining operations, stating at the IMF’s Regional Economic Outlook for sub-Saharan Africa, that the lack of revenue generated from the government’s equity share was because “many of the mining companies say they are not making profits to pay dividends but they keep mining, notwithstanding the fact that they are unprofitable.”3‘

The government of Ghana holds these shares and the non-tax revenue unit of the Ministry of Finance collects the revenues. The government is provided this equity interest without having to make financial contributions to the development or operations of the project. The government has equity share interests in every gold mining operation in the country bar those owned by Newmont Mining or AngloGold Ashanti following the signing of updated mining development agreements. In the case of AngloGold Ashanti, the government has a stake of 1.55 percent in the global company AngloGold Ashanti Limited.

The NRGI report concludes that “the payments-to-governments disclosures made by international mining companies operating in the country suggest that if revenue generation is the primary purpose of this state equity participation, then the government may want to reconsider this approach”. This has been evident to many in the industry for a very long time.