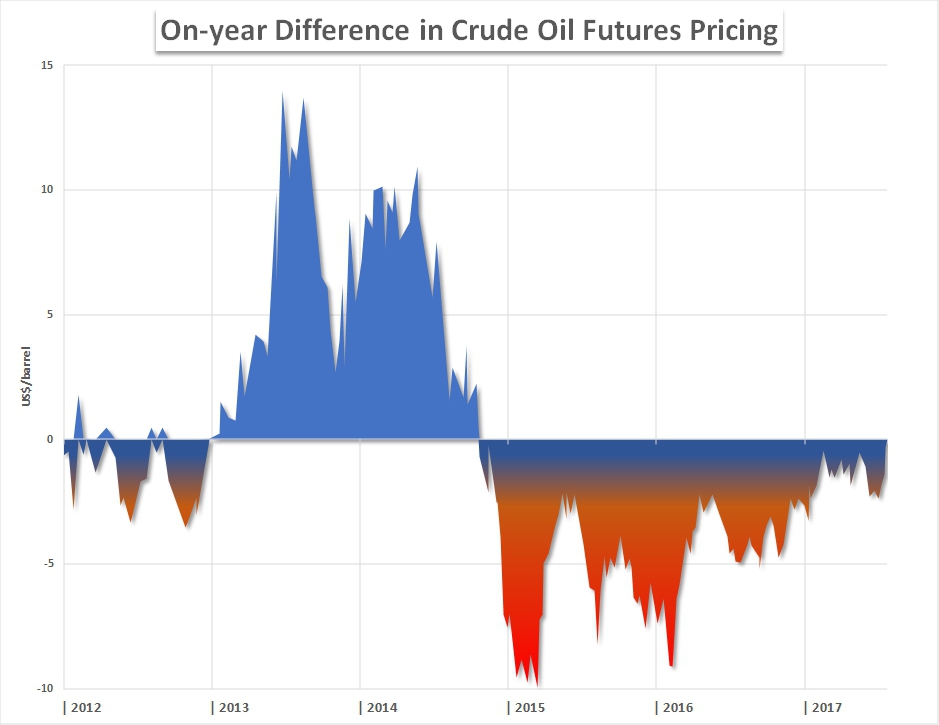

As we suggested earlier the oil markets are moving in an interesting direction. It seems we are about to see the crude oil market move into backwardation for the first time since 2014. This will be a very important move for traders as during contango traders are forced to sell low and buy high to cover their positions.

Since 2014 future delivered oil sold for more than the spot price. This is a reflection of the supply-demand, there being abundant supply for the spot market. This simply encourages traders to place oil in storage. However commercial crude oil in storage in the USA has been dropping according to the EIA. This has likely been driven by the closing gap between one-year futures pricing and spot and the impact of OPEC supply restriction. Storing oil after transport and storage costs is no-longer profitable.

The cap on a move into backwardation is the new dynamic of US tight oil which has become very sensitive to any price increase. Expect to move into backwardation in the coming 6 months if commercial storage volumes continue to fall and OPEC maintains its production resolve.

Backwardation: Near-term prices above longer term prices

Contango: Near-term prices are below longer-term prices