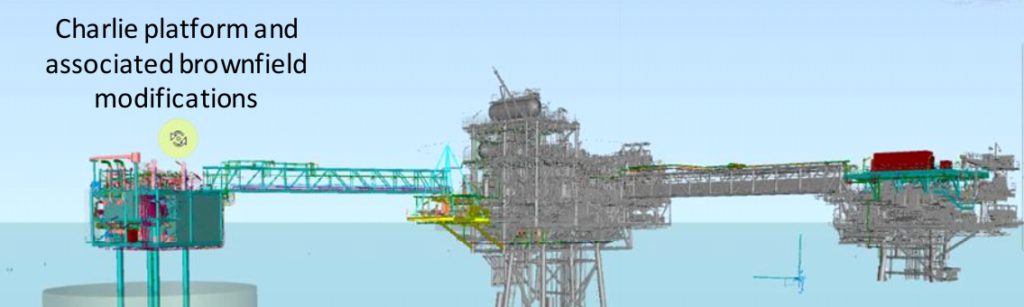

Solstad Offshore ASA has been awarded a contract by Ophir Thailand (Bualuang) Limited to perform the offshore installation of the Bualuang Charlie wellhead platform structure as part of the Bualuang Phase 4B Development Project. The Charlie platform will have 12 slots at full production will increase field production to 11,000 BOPD.

The project is located in the Gulf of Thailand and comprises the installation of a bridged-linked wellhead platform structure along with the retrofitting of extension structures to existing in-field platforms. Offshore activities are planned to commence in July 2019 and will be performed using the Derrick Lay Barge “Norce Endeavour”. Solstad Offshore will perform all project management, engineering and installation activities from its offices in Singapore.

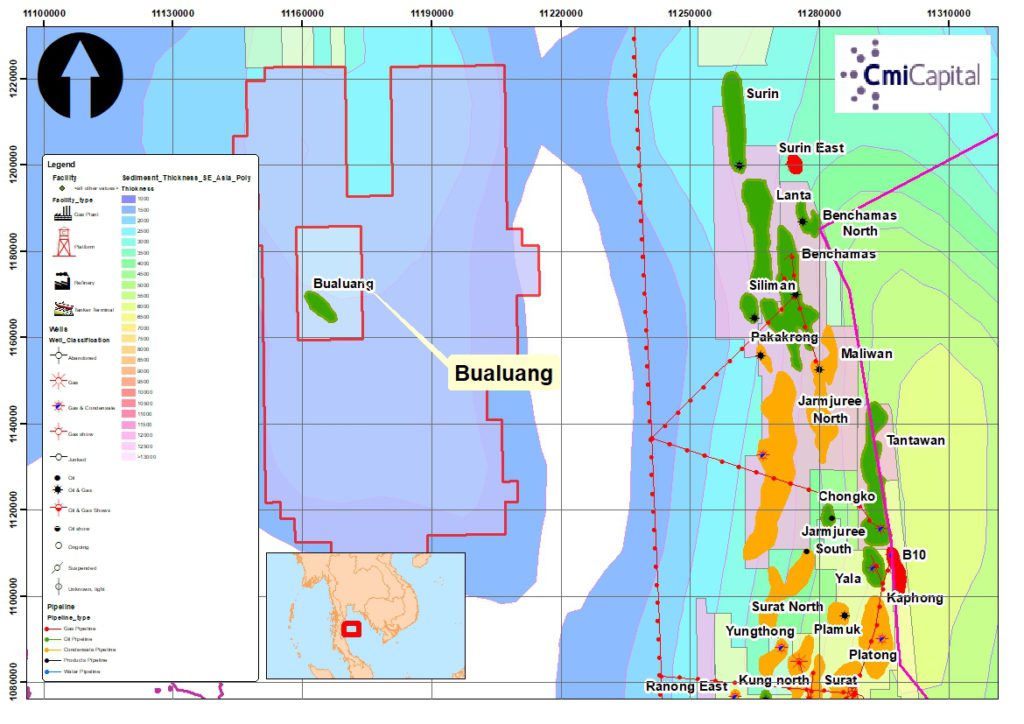

Bualuang Oil Field

The Bualuang oil field in the Gulf of Thailand has been on-stream since 2008. The field was initially thought to contain 15 mmbo of 2P reserves and have a productive life of approximately five years. However, the field has undergone numerous reserve upgrades and year-end 2018 it had produced over 35 million barrels of oil, with a further 27 mmbo of 2P reserves and 10.3 mmbo of 2C resource.

- The Bualuang field has been on-stream since 2008

- Stable production with over 99% uptime in 2018. 7,800 BOPD during 2018, to be increased to 11,000 BOPD

- OPEX US$13/BOPD increase to US$16 BOPD in 2018.

- A facilities debottlenecking project in 2016 increased water handling capacity, and therefore allowed for increased rates of oil production

- A three well infill drilling campaign in 2017 saw two wells in the deeper T2 reservoir and and infill well under the platform guided by data from the Ocean Bottom Node seismic survey completed in 2015.

- Phase 4 commenced in 2018 with drilling of three new wells and four workovers.

Phase 4B Development

- A third platform with 12 slots allowing expansion of water disposal to 100k BPD;

- 10 slots to be used for increased production with conversion of some wells on the Bravo platform to water disposal.

- CAPEX: US$138 million

- Development drilling from July 2019 with first oil from Charlie in October 2019

Medeco to Acquire Ophir Energy

On 30 January 2019, the boards of Medco, Medco Global and Ophir announced that they had reached agreement on the terms of a recommended acquisition pursuant to which Medco Global will acquire the entire issued and to be issued ordinary share capital of Ophir for GBP 0.55 per share (later revised upwards to GBP 0.575). This all cash bid valued the company at US$ 550 million.

A number of activist institutional investors were unhappy with the bid and on 8 March 2019, the Ophir Board received an unsolicited and highly preliminary indication of interest from Coro Energy PLC regarding a possible offer for the entire issued and to be issued share capital of Ophir. Coro proposed that Ophir Shareholders would receive 40 pence in cash, and, in addition, shares in Coro for each Ophir Share, resulting in an ownership by Ophir Shareholders of between 85 per cent. and 95 per cent. of the enlarged company. The cash component would be funded with debt.

Following a modest increase in the offer price by Modeco, Coro withdrew its offer after discussions with their financiers, Sand Grove Capital Management.

Note: Cmi Capital holds shares in Ophir Energy.