and its all for this – Sample 200024

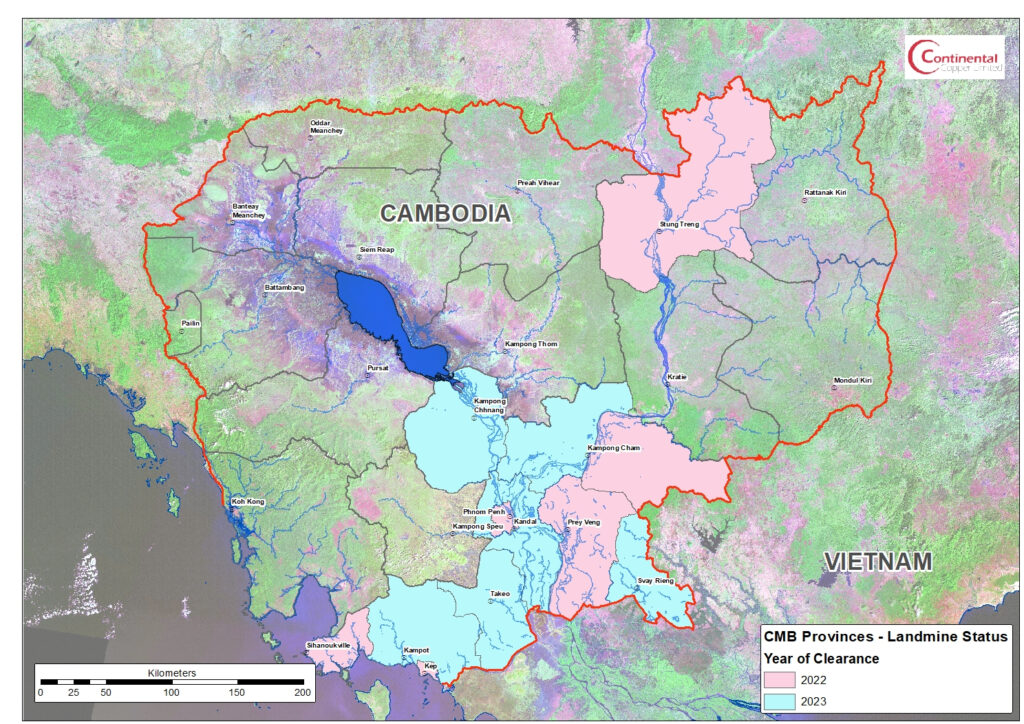

During Vietnam and the Thai-Cambodian war the Border regions of Cambodia were heavily mined, with mines produced exclusively in China – at least 8 million of them. In the last 30 years the Cambodian Government and private de-mining charities have been systematically demining the country. Demining which is very labour intensive now achieves 250 km2 of clearance per year in Cambodia.

A total of five provinces and the capital had been declared mine-free as of December, as Cambodia’s 2025 goal of becoming mine-free approaches. Stung Treng, Kep, Prey Veng, Preah Sihanouk and Tbong Khmum were declared mine free in December 2022 and Kampong Cham, Takeo, Kampong Chhnang, Kampot, Svay Rieng, and Kandal are expected to be mine-free in 2023.

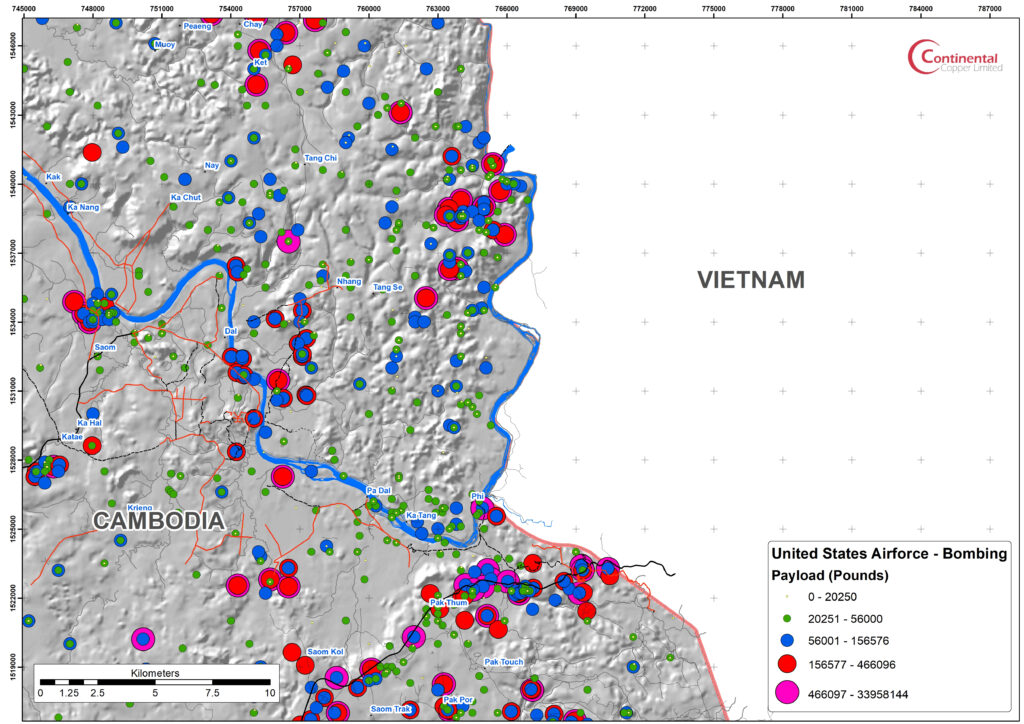

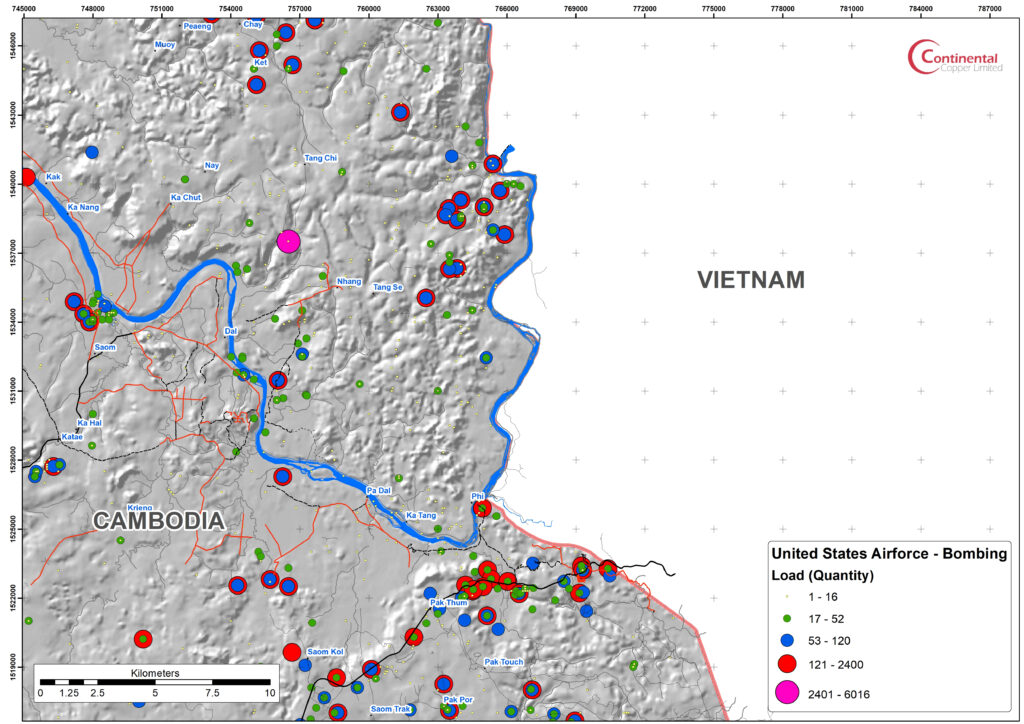

Unexploded ordnance (UXO, sometimes abbreviated as UO), unexploded bombs (UXBs), and explosive remnants of war (ERW or ERoW) are explosive weapons (bombs, shells, grenades, land mines, naval mines, cluster munition, and other munitions) that did not explode when they were employed and still pose a risk of detonation, sometimes many decades after they were used or discarded.

The major contributor to the Cambodian UXO legacy was the aerial bombing campaign conducted by the United States Airforce during the Vietnam War. The most intense bombing was area denial along the Vietnamese border and the extent of this bombing can be see in the following images. The total ordnance dropped was 2.8 Mt (6.1 billion pounds) comprising 2.5 million individual munitions carried in 230,000 sorties.

Land mine clearance organizations include

Copper concentrates come in two “flavours” – Clean and Complex.

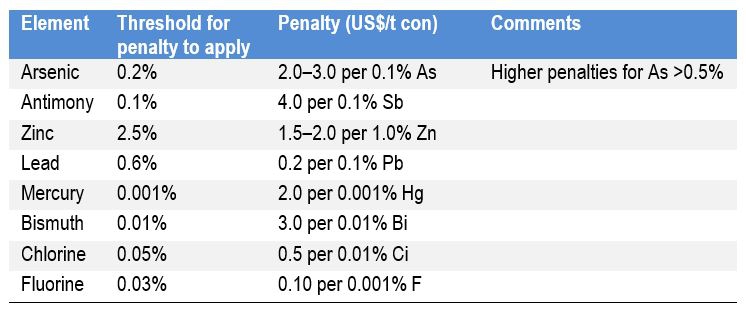

Clean copper concentrates have more than 20% copper and possibly gold and silver and low levels of the deleterious elements As, As, Bi, Cd, Cl, F, Pb, Hg, U and Zn. In addition, asbestos (referred to as fibre) is present in a small number of mine product streams. The Complex Concentrates have high levels of one or more deleterious elements. Each of the deleterious elements will have a threshold level in the offtake contract where the smelter will charge a penalty in addition to the treatment and refining charges. The penalty accommodates the increased costs of disposal and safe disposal.

There is frequently an upper limit for some deleterious elements, above which the smelter may refuse to accept the concentrate.

The most common deleterious element in copper concentrates is arsenic. Globally 65% of copper concentrates have less than 0.1% As. Above 0.2% arsenic, copper concentrates are considered to be Complex Concentrates and will be charged penalties. In the last decade, as new mine copper production has slowed the quantities of Complex Concentrates entering the market increased significantly while smelter capacity for these concentrates has declined.

Complex concentrates from Marcapunta in Peru (8% As), Chelopeche in Bulgaria (6% As) and Chuquicamata in Chile (1.2% As) have been the main producers. They have been joined more recently by production form Toromocho in Peru (1% As) and Ministro Hales in Chile (4% As).

Prior to the 1990s there were many smelters that would accept copper concentrates with high deleterious element concentrations. However due to environmental concerns, liability concerns, tightening regulations and smelter closures at La Oroya in Peru, San Luis de Potosi in Mexico, Tacoma in the USA, Rönnskär in Sweden, PASAR in the Philippines and Kosaka in Japan, the number of smelters that will now regularly accept Complex Concentrates has declined very significantly.

Smelters that will now accept Complex Concentrates include Tsumeb in Namibia, Altonorte in Chile, Guixi in China and Horne in Canada. For complex concentrates that contain more than 1% arsenic, the Dundee Precious Metals smelter in Namibia at Tsumeb is now the only smelting option.

Most of the smelters which would previously accept high arsenic concentrates utilised roasters to fume of the Arsenic to produce arsenic trioxide (for which there is a limited market) and calcined copper with much reduce arsenic levels. Only Tsumeb still operates such a process facility.

Codelco installed an Outotec Partial Roaster (a fluid bed roaster) at its Ministro Hales mine in 2013 to reduce the as content of the copper concentrates. It is located close to Codelco’s Radomiro Tomic and Chuquicamata operations. Initially the project comprised an open pit mine, a 50 kt/d mill to produce 163 kt/a Cu and 287 t/a silver over a 14-year mine life. The ore contains a significant amount of arsenic (around 1.6-1.9% As) that results in production of concentrate with arsenic content just above 4%. To reduce the arsenic levels, a 550 kt/a fluid-bed roaster was constructed to safely process copper concentrate and recover arsenic for further confinement. In addition to calcine and sulphuric acid, the roaster produces flue dust (around 4% volume) containing 22% Cu.

Hydrometallurgical Treatment Options

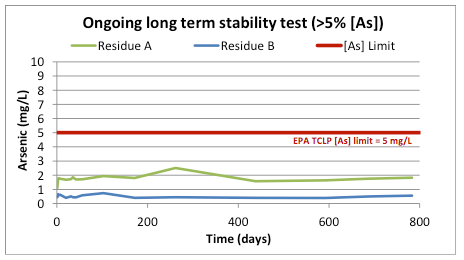

There are a number of hydro-metallurgical treatment options (few of which have achieved commercial success) which do not involve roasting where the objective is to produce a residue containing arsenic in a form which is stable within a tailings dam. These process routes include atmospheric leaching, bio-oxidation and pressure leaching. Dundee Precious Metals prior to its acquisition of the Tsumeb smelter had attempted to permit a pressure oxidation circuit at its Chelopeche mine in Bulgaria but faced opposition for the usual socialist “ecological” groups.

Teck Aurubis have trialled their proprietary high pressure oxidation technology, CESL, on concentrates with up to 10% arsenic and report greater than 99% deportment of arsenic to leach residues. Arsenic components in the residue have been identified as ferric arsenate and scorodite – both of which are considered the most stable forms for arsenic fixation. Teck Aurbis have achieved >97% copper and >90% Au and Ag recovery, LME grade copper cathode and gold and silver Dore production.

Blending Options

Due to the limited capacity and high costs of the smelters capable of accepting high arsenic concentrate, blending of clean and complex concentrates to produce a product that is below the smelter deleterious element thresholds has become a significant business opportunity. Generally, this is below the 0.5% Chinese threshold and the main blended concentrate target is Chinese smelters.

In 2014 Codelco set up a strategic alliance with Ocean Partners to blend high-As copper concentrate from its Ministro Hales mine with clean third-party concentrate bought in by both companies, at Ocean Partners’ concentrate blending facility in Taiwan.

In the near term it appears likely that the percentage of concentrates subject to arsenic penalties will increase, as will the percentage of Complex Concentrates in the market. In response to this Glencore has opened a new copper concentrate blending facility in Taiwan and a number of Chinese smelters are looking at locating blending and scrap processing operations in the region.

While copper futures trade in largely directionless, trading in a tight range there has been considerable action in the concentrate markets.

Reuters reports that the 10-member China Smelters Purchase Team (CSPT) has set treatment and refining charges at $55.00 per tonne and 5.5 cents per lb respectively for third-quarter deliveries. This is a significant move down from $92 and 9.2 cents in Q1 2019. This suggests considerable tightness on the copper concentrate supply side and could spell some grief and likely closures for higher cost smelters.

According to the International Copper Study Group (ICSG) the issues with the supply side are the dearth of new mine production combined with lower head grades in Chile and markedly lower output at Grasberg where the operation is in the process of transition from open pit to underground.

ICSG in its latest study concludes that world mine production declined by about 1% in the first four month of 2019, with concentrate production declining by 0.5% and solvent extraction-electrowinning (SXEW) by 2.5%:ICSG in its latest study concludes that:

ICSG in its latest study concludes that world refined production remained unchanged in the first four month of 2019 with primary production (electrolytic and electrowinning) declining by 0.2% and secondary production (from scrap) increasing by 0.5%. The decline in world production was due to:

Refined copper declines during the period were offset by growth in Chinese output and increases in Australia, Brazil, Iran and Poland . These declines during the period were offset by growth in Chinese output and increases in production due to recovery from production constraints in 2018.

ICSG concludes that:

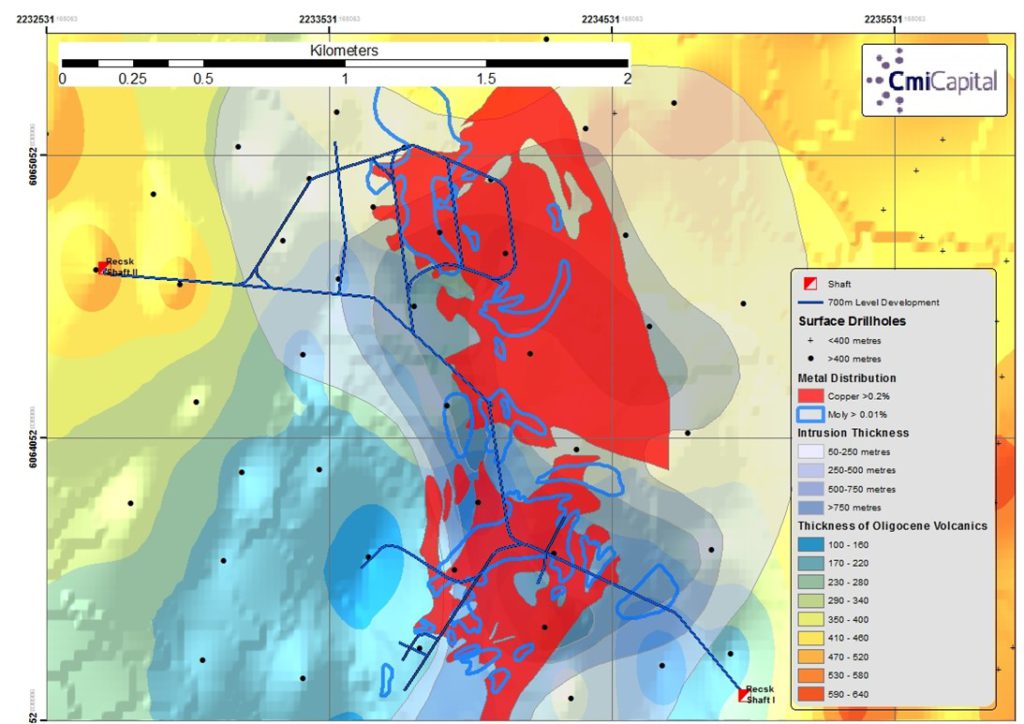

Hungarian National Asset Management Inc., (“MNV”) has announced the public tender for the Recsk Deposit and assets in Hungary.

The Recsk Cu-Au-Pb-Zn-Ag-Mo property in Hungary hosts arguably one of the largest and highest-grade undeveloped copper-gold porphyry and skarn systems in Europe. With 240,000 metres of drilling, two 8 metre internal diameter, 1,200-metre-deep, concrete lined shafts and 9 kilometres of underground development, the Recsk deposit is estimated to contain 5.6 million tonnes (12 billion pounds) of copper and 4 million ounces of gold.

Recsk_Tender_Review_20180927.1

Cmi Capital is available to assist a suitable party to participate in the tender. Cmi Capital held extended discussions with the Government of Hungary prior to the announcement of the tender and as such has a unique understanding of the deposit and the political and economic environment. Cmi Capital or an associated corporation seeks a long-term concentrate offtake agreement on commercial terms and may at its sole discretion provide up to US$250 million in an offtake pre-payment repaid from production with the usual customary terms and conditions following completion of an advanced economic & technical study.

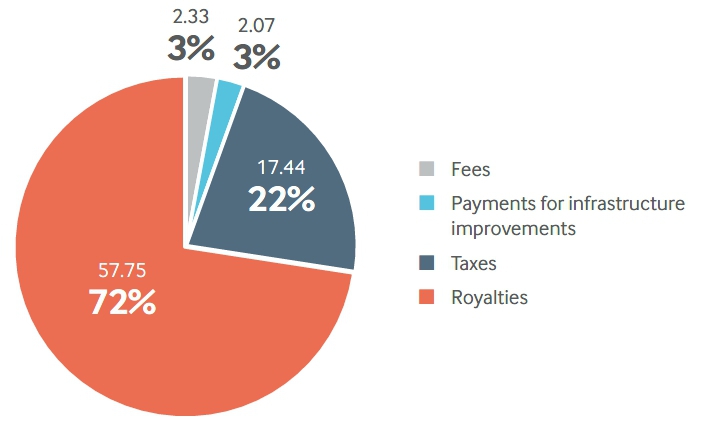

Natural Resource Governance Institute has issued a report on revenues received from listed mining companies in Ghana. As many who have done the cashflow analysis have long known that a free carried interest, funded out of cashflow is a less than effective tool for garnering rent from resource projects. Projects can often take many years to repay capital and if this period corresponds with low or stagnant commodity prices then dividend payments may be low. In effect the state is fully exposed to commodity price and operational risks. A better solution is a competitive royalty, fee and taxation environment which is adequately regulated.

One of the issues with a carried interest is that this often involves representation on the board of the operating entity and as such creates immediate conflicts of interest for directors and heated domestic competition for these positions. That said, there are often political arguments for a carried interest, arguments about national interest. In addition it has been argued that being represented on the board of the operating entity allows governments to “keep an eye on” the operator. A better solution is robust oversight by a suitably trained and funded Department of Mines.

ghana-gold-mining-revenue-analysis-company-disclosures

In Ghana the majority of international mining companies, including Asanko Gold, Golden Star Resources, Endeavour Mining, Kinross Gold, Perseus Mining and Xtra-Gold Resources, have disclosed payments-to-governments reports under the Extractive Sector Transparency Measures Act (ESTMA) in Canada. In addition Gold Fields, AngloGold Ashanti and Newmont Mining have made voluntary disclosures regarding the payments they make to the Ghanaian government.

Data were sourced from companies complying with the Canadian, Extractive Sector Transparency Measures Act (ESTMA).

In 2017 nearly three quarters of the payments to Ghanaian government entities by ESTMA companies in the gold sector arose from royalties, with five companies paying a total of USD 57 million. A further 22 percent of the payments from these ESTMA companies were in the form of corporate income tax. While six operating companies paid royalties in 2017, only two, Kinross Gold Corporation and Endeavour Mining paid corporate taxes.

Ghana’s Vice President Mahamudu Bawumia has questioned the utility of the government’s 10 percent equity interest in mining operations, stating at the IMF’s Regional Economic Outlook for sub-Saharan Africa, that the lack of revenue generated from the government’s equity share was because “many of the mining companies say they are not making profits to pay dividends but they keep mining, notwithstanding the fact that they are unprofitable.”3‘

The government of Ghana holds these shares and the non-tax revenue unit of the Ministry of Finance collects the revenues. The government is provided this equity interest without having to make financial contributions to the development or operations of the project. The government has equity share interests in every gold mining operation in the country bar those owned by Newmont Mining or AngloGold Ashanti following the signing of updated mining development agreements. In the case of AngloGold Ashanti, the government has a stake of 1.55 percent in the global company AngloGold Ashanti Limited.

The NRGI report concludes that “the payments-to-governments disclosures made by international mining companies operating in the country suggest that if revenue generation is the primary purpose of this state equity participation, then the government may want to reconsider this approach”. This has been evident to many in the industry for a very long time.

To the Daily Alta California, it was “the great discovery of the age”. After emerging from the underground at the California Mine on the Comstock Lode Dan de Quille called it “the richest mineral discovery in the world’s history” and he named it The Big Bonanza. In a field of exceedingly high-grade mineralization the Big bonanza would generate immense wealth.

“Not a pebble in the crosscut was worth less than US$600 per ton and no small sample could be reasonably assayed for fear of grabbing a sulphuret nodule that would run the chunk into the thousands of dollars a ton.” Bear in mind these are 1870 dollars, likely worth US$20,000 per tonnes in today’s dollars.

“Sometime in the first half of 1875, as cross cuts on the 1,500 foot level reveled that the ore body did indeed span the entire length of the California mine, John Mackay must have realised that The Big bonanza would make him one of the richest men in the world.”

Chris Ralph/Nevada Outback Gems

The Bonanza King is a well researched history of the Comstock Lode and characters involved. The book underlines the importance and occasional reward for focused hard work in the industry. Strongly recommended for mining folks.

Pyrargyrite is a sulfosalt mineral consisting of silver sulfantimonide, Ag3SbS3. Known also as dark red silver ore or ruby silver, it is an important source of the metal.

Additional Reading

Bonanza Ores of the Comstock Lode, Viginia city, Nevada, Economic Geology, 1922

The Society of Economic Geologists newsletter is now available. You do need to be a member to access this! Not a Member – go here.

Dr Roger Taylor is presenting three economic geology short courses in Melbourne in August. Strongly recommended.

Morgan Stanley report today that they expect lithium carbonate prices to drop from the current level of US$ 13,375/t to US$ 7,030/t by 2020. This is far lower than the consensus view after lithium prices surged 100% in the last 2 years.

Substantial supply increases are driving their forecast, with Morgan Stanley reporting that the largest producers in Chile are planning on adding 500,000 tonnes per year in new mine supply by 2025. This supply would swamp the anticipated growth in demand from battery production. Indeed Morgan Stanley predict that the lithium market will go into surplus in 2019… and stay there.

The firm has downgraded two of the largest producers, Albemarle Corporation (NYSE: ALB) and Sociedad Quimica y Minera S.A. (SQM: NYSE SQM) which are planning to bring an additional 200,000 tonnes of lithium on stream by 2025. This will cement the position of Chile as the largest global producer with a >30% share.

Most of the lithium hopefuls listed on western stock-exchanges have used lithium carbonate prices in the range of US$11,000 and 13,500/t in economic studies and the majority of these projects would struggle if prices were to tumble. Given the rush to lithium of recent times and the nature of commodity markets we suspect that Morgan Stanley are likely correct. Even a dramatic increase in market penetration for electric cars (which now seems increasingly unlikely given the growing trend away from government subsidies) would do little to change the supply demand dynamic in the coming few years unless the fall in price is sufficiently steep as to stop or delay some of the larger projects now being contemplated. Now that is always a possibility.

An exception may be spodumene producers like Pilbara Minerals Limited (ASX: PLS) which showed a >50% return on investment in a planned expansion at a spodumene price of US$550/t, a 60% discount to the current spot.