Here is a brief paper, by Ralica Sabeva Vassilka Mladenova and Aberra Mogessie on the gold deposits around the small western Bulgarian town of Breznik. I acquired this project for Euromax Resources Limited back in 2003 and we explored this until my departure in 2010. A rather nice intermediate sulphidation gold deposit which has now had the necessary fluid inclusion and sulphur isotope work conducted by Bulgarian and Austrian researchers.

Stay current on Geoscience research subscribe to Cmi Geoscience

Our intention while I was CEO was to devleop this deposit using adits and an internal winze. .

Highlights

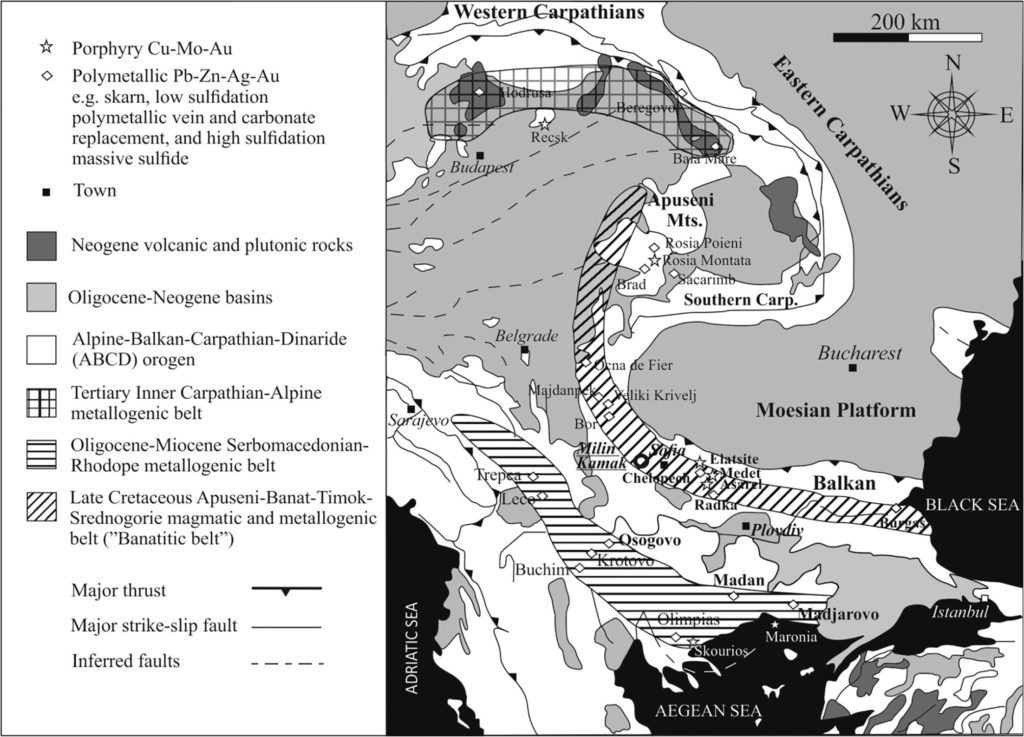

- Situated in the Late Cretaceous 80-100km wide Apuseni-Banat-Timok-Srednogorie (ABTS) magmatic and metallogenic belt;

- The deposit is hosted by altered trachybasalt to andesitic trachybasalt volcanic and volcanoclastic rocks;

- 2.4 Mt at 5.91 g/t Au and of 26.78 g/t Ag, the probable reserves and resources are 13.1 tonnes of gold and 59.5 tonnes of silver;

- Strike of 400-1000 metres and widths of cms up to 15 metres;

- Temperature of formation ~238 to 273°C, salinity of 3.7-6.6% and δ34S average of 1.350/00 suggestive of a magmatic sulphur source;

- Fluid evolution from a low sulphidation through later intermediate (precious metals) stage.

Abstract

The Milin Kamak gold-silver deposit is located in Western Srednogorie zone, 50 km west of Sofia, Bulgaria. This zone belongs to the Late Cretaceous Apuseni-Banat-Timok-Srednogorie magmatic and metallogenic belt. The deposit is hosted by altered trachybasalt to andesitic trachybasalt volcanic and volcanoclastic rocks with Upper Cretaceous age, which are considered to be products of the Breznik paleovolcano. Milin Kamak is the first gold-silver intermediate sulfidation type epithermal deposit recognized in Srednogorie zone in Bulgaria. It consists of eight ore zones with lengths ranging from 400 to 1000 m, widths from several cm to 3–4 m, rarely to 10–15 m, an average of 80–90 m depth (a maximum of 200 m) and dip steeply to the south. The average content of gold is 5.04 g/t and silver – 13.01 g/t. The styles of alteration are propylitic, sericite, argillic, and advanced argillic. Ore mineralization consists of three stages. Quartz-pyrite stage I is dominated by quartz, euhedral to subhedral pyrite, trace pyrrhotite and hematite in the upper levels of the deposit. Quartz-polymetallic stage II is represented by major anhedral pyrite, galena, Fe-poor sphalerite; minor chalcopyrite, tennantite, bournonite, tellurides and electrum; and trace pyrrhotite, arsenopyrite, marcasite. Gangue minerals are quartz and carbonates. The carbonate-gold stage III is defined by deposition of carbonate minerals and barite with native gold and stibnite.

Fluid inclusions in quartz are liquid H2O-rich with homogenization temperature (Th) ranging from 238 to 345 °C as the majority of the measurements are in the range 238–273 °C. Ice-melting temperatures (Tm) range from −2.2 to −4.1 °C, salinity – from 3.7 to 6.6 wt.% NaCl equiv. These measurements imply an epithermal environment and low- to moderate salinity of the ore-forming fluids.

δ34S values of pyrite range from −0.49 to +2.44‰. The average calculated δ34S values are 1.35‰. The total range of δ34S values for pyrite are close to zero suggesting a magmatic source for the sulfur.

Read the Full Text Here

Breznik a Centre of Local Culture & Spectacular Kukeri Festival

Breznik is a delightful small town in western Bulgaria and well worth a visit.

In the middle of winter across the Balkans, Kukeri festivals allow for mid-winter celebrations.

Kukeri are elaborately costumed Bulgarian men (and some wonen) who perform traditional rituals intended to scare away evil spirits. Closely related traditions are found throughout the Balkans and Greece (including Romania and the Pontus). The costumes cover most of the body and include decorated wooden masks of animals (sometimes double-faced) and large bells attached to the belt. Around New Year and before Lent, the kukeri walk and dance through villages to scare away evil spirits with their costumes and the sound of their bells. They are also believed to provide a good harvest, health, and happiness to the village during the year. The custom is generally thought to be related to the Thracian Dionysos cult in the wider area of Thracia. (after Wikipedia)