“In 1923, seven men who had made it to the top of the financial success pyramid met together at the Edgewater Hotel in Chicago. Collectively, they controlled more wealth than the entire United States Treasury, and for years the media had held them up as examples of success.

Who were they? Charles Schwab, president of the world’s largest steel company, Arthur Cutten, the greatest wheat speculator of his day, Richard Whitney, president of the New York Stock Exchange, Albert Fall, a member of the President’s Cabinet, Jesse Livermore, the greatest bear on Wall Street, Leon Fraser, president of the International Bank of Settlement, and Ivan Kruegger, the head of the world’s largest monopoly.

What happened to them? Schwab and Cutten both died broke; Whitney spent years of his life in Sing Sing penitentiary; Fall also spent years in prison, but was released so he could die at home; and the others Livermore, Fraser, and Kruegger, committed suicide”.

Donald McCullogh, Waking from the American Dream

Charles Schwab

Charles Michael Schwab (February 18, 1862 – September 18, 1939) was an American steel magnate. Under his leadership, Bethlehem Steel became the second largest steel maker in the United States, and one of the most important heavy manufacturers in the world. A fortune of $500 million prior to 1929 was all but wiped out in the October collapse and he spent his final years in a small apartment. Shortly after his death, World War 2 restored the fortunes of his steel company, Bethlehem Steel.

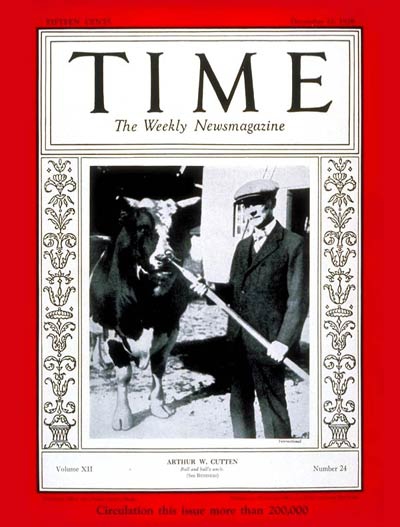

Arthur Cutten

Arthur William Cutten (July 6, 1870 – June 24, 1936) was a Canadian-born businessman who gained great wealth and prominence as a commodity speculator in the United States. He was all but wiped out in the 1907 collapse of the cotton markets.

He appeared before the Banking and Currency Committee during its investigation of the Wall Street Crash of 1929. The government issued indictments against him for tax evasion. He died of a heart attack a few weeks short of his sixty-sixth birthday. The tax suit was settled by the executors of his estate as his fortune was vastly depleted by the stock market crash and the cost of lawyers to defend him from the government lawsuits.

Richard Whitney

Richard Whitney (August 1, 1888 – December 5, 1974) was an American financier and president of the New York Stock Exchange from 1930 to 1935. Having retired as president of the New York Stock Exchange in 1935, Whitney remained on the board of governors, but in early March 1938, his past began to catch up with him when the financial controller of the exchange reported to that Richard Whitney was an embezzler and that his company was insolvent. Within days, events snowballed, and Whitney and his company would both declare bankruptcy. He was convicted of embezzlement and imprisoned. On April 12, 1938, six thousand people turned up at Grand Central Terminal to watch as Whitney was escorted in handcuffs by armed guards onto a train that delivered him to prison.

Jesse Livermore

Jesse Lauriston Livermore (July 26, 1877 – November 28, 1940) was an American investor. A legendary trader who worked alone without partners and in isolation from others in an office of advanced technology for the time, receiving price data directly from the floor of the NYSE. He made and lost his fortune on numerous occasions. His skill was market timing combined with considerable mathematical skills and a clear trading strategy. He would invest a small portion of his planned amount and see how the market reacted. If the price continued to increase, he would invest yet more until he was convinced of the general trend of the market before securing his ultimate position. He would not tolerate a fall in price of more than 10% and would sell his position quickly, thereby not endangering his capital.

On November 28, 1940, Livermore fatally shot himself in the cloakroom of the Sherry Netherland Hotel in Manhattan. Police found a suicide note of eight small handwritten pages in Livermore’s personal, leather bound notebook. The note addressed to Livermore’s wife Harriet (whom Livermore nicknamed “Nina”) read, “My dear Nina: Can’t help it. Things have been bad with me. I am tired of fighting. Can’t carry on any longer. This is the only way out. I am unworthy of your love. I am a failure. I am truly sorry, but this is the only way out for me. Love Laurie”

Leon Fraser

Leon Fraser (born November 27, 1889 in Boston, April 8, 1945) was an American manager.

Fraser graduated from Columbia University and from Colgate University Law School. He worked as a reporter for New York World until he was admitted to the bar in 1914. He enlisted in the US Army and fought in WW1 leaving with the rank of officer. From 1922 to 1924 he practiced international law in Paris. He was a consultant for the Dawes Plan and from 1924 to 1927 was the Paris representative for reparations payments.

In 1930 he became president of the newly established Bank for International Settlements. In 1937 he became president of the First National Bank of New York. He also held senior positions with General Electric, US Steel and the Federal Reserve Bank of New York. In the courtyard of his Granville home, Fraser shot himself in the head. His farewell letter pointed to depression.

Ivan Kruegger

Ivar Kreuger (2 March 1880 – 12 March 1932) was a Swedish civil engineer, financier, entrepreneur and industrialist. In 1908, he co-founded the construction company Kreuger & Toll Byggnads AB, which specialized in new building techniques. By aggressive investments and innovative financial instruments, he built a global match and financial empire. He ultimately controlled between two thirds and three quarters of worldwide match production, becoming known as the “Match King”.

Kreuger’s financial empire collapsed during the Great Depression. A subsequent audit of his more than 400 companies concluded that “The manipulations were so childish that anyone with, but a rudimentary knowledge of bookkeeping could see the books were falsified.” In March 1932, he was found dead in the bedroom of his flat in Paris. The police concluded that he had committed suicide although his family believed he had been murdered.

Albert Fall

Albert Bacon Fall (November 26, 1861 – November 30, 1944) was a United States Senator from New Mexico and the Secretary of the Interior under President Warren G. Harding, infamous for his involvement in the Teapot Dome scandal. Fall was appointed to the position of Secretary of the Interior by President Warren G. Harding in March 1921. Soon after his appointment, Harding convinced Edwin Denby, the Secretary of the Navy, that Fall’s department should take over responsibility for the Naval Reserves including the Teapot Dome Naval Reserve in Wyoming.

In April 1922 Wall Street Journal reported that Secretary Fall had issued oil drilling permits within the Teapot Dome Naval Reserve in Wyoming to two of his friends, oilmen Harry F. Sinclair (Mammoth Oil Corporation) and Edward L. Doheny (Pan-American Petroleum and Transport Company) after receiving a bribe of $385,000.

Fall was found guilty of conspiracy and bribery and was jailed for one year as a result—the first former cabinet officer sentenced to prison as a result of misconduct in office.